Public Mining Companies Offer Better-Than-Bitcoin Price Exposure in 2023

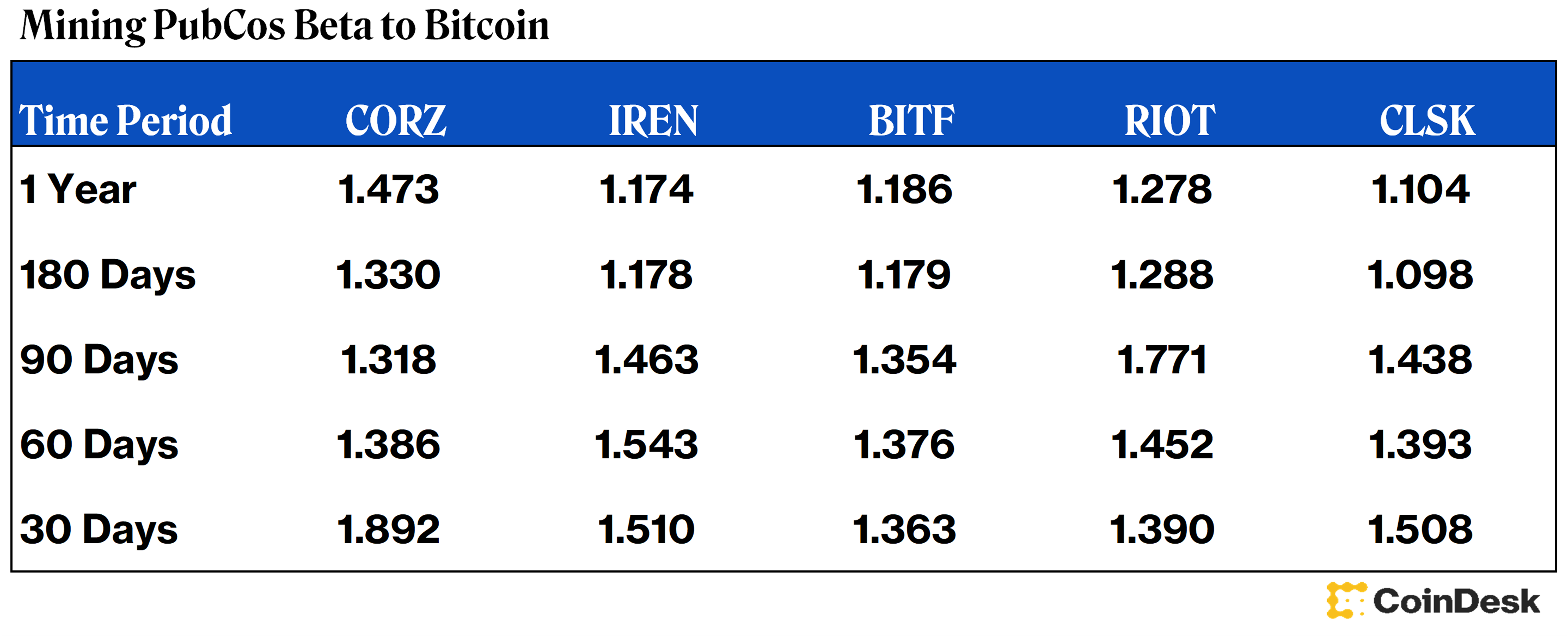

Core Scientific (CORZ), Riot Blockchain (RIOT), Bitfarms (BITF), Iris Energy (IREN) and CleanSpark (CLSK) have performed better than BTC this year, as this chart shows.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IYNKCMVIINHUNOP2FIWRTXLM5E.jpg)

Bitmain Antminer S19 Hydro mining rigs, the company's latest technology, installed at a Merkle Standard facility in Washington state. (Eliza Gkritsi/CoinDesk)

Bitcoin is having a stellar 2023, gaining 75% so far. That type of price performance invariably piques investor interests. For those who still limit themselves or are limited to investment in public equity and debt securities, there is at least one way to get exposure to the movement in bitcoin’s price: public mining stocks.

These companies – Core Scientific (CORZ), Riot Blockchain (RIOT), Bitfarms (BITF), Iris Energy (IREN) and CleanSpark (CLSK) – have traded up 947%, 442%, 300%, 458% and 212%, respectively. That said, at the beginning of the crypto bear market last year, almost all of these stocks were hit harder than bitcoin.

This story is part of CoinDesk's 2023 Mining Week, sponsored by Foundry.

This trend has led to the notion that mining stocks act as a high beta bitcoin trade. Beta is a measure of a stock’s volatility in relation to the overall market. A beta greater than 1.0 suggests that the stock is more volatile than the broader market, and a beta less than 1.0 indicates a stock with lower volatility.

If we consider the “overall market” to be bitcoin, all the aforementioned mining stocks have seen greater than 1.0 beta (on various lookback time periods) to bitcoin, suggesting they do in fact offer that high beta bitcoin trade (i.e. additional upside or downside on trading bitcoin alone).

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/509dbe31-e71d-4919-832e-6c3fb89ce470.png)