Bitcoin Reverts to $29.6K as Dollar Index, Treasury Yields Shrug Off U.S. Rating Downgrade

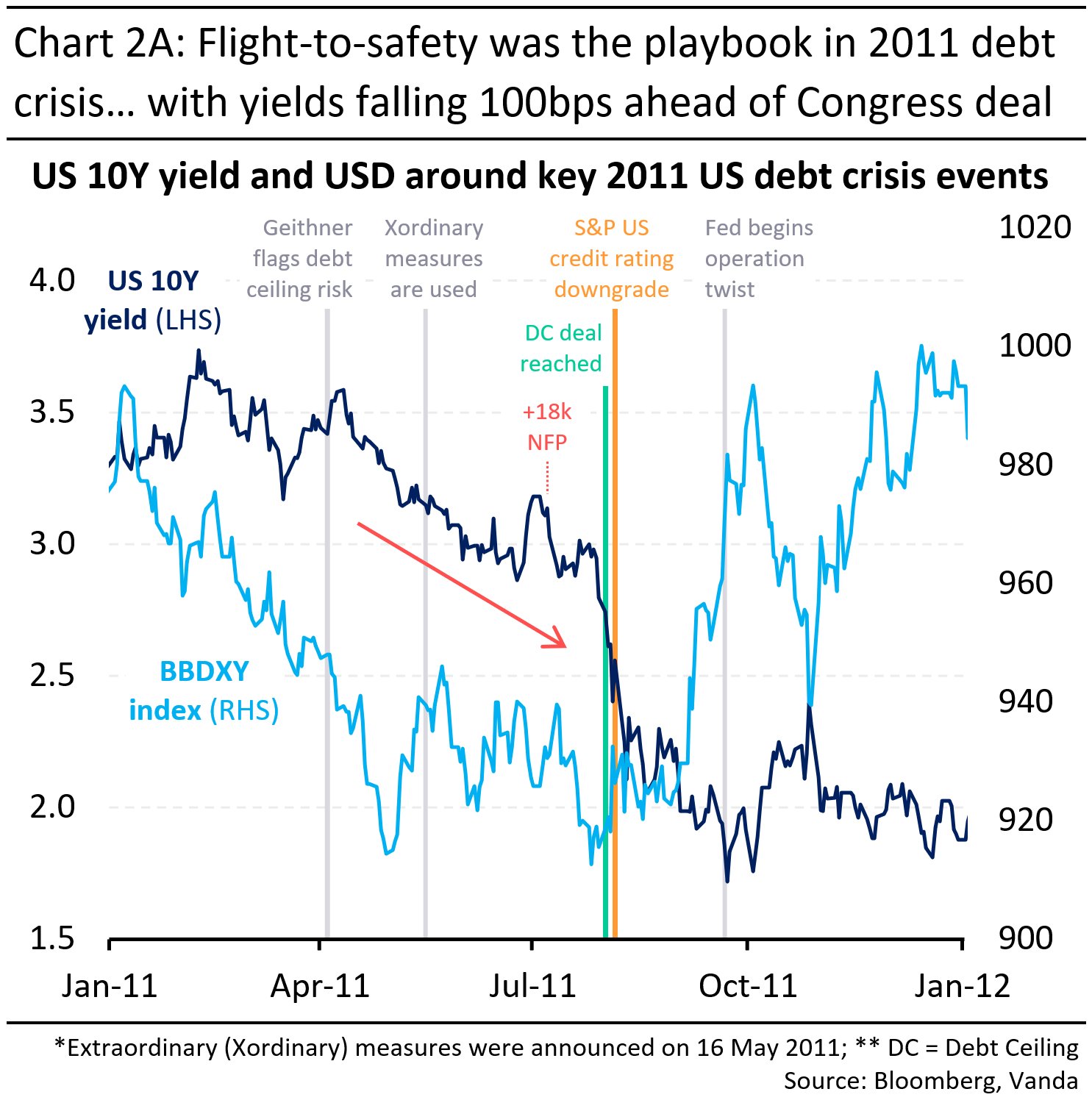

Fitch downgraded the U.S. credit rating to AA+. A similar downgrade by S&P in early August 2011 had cratered risk assets, including bitcoin.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Y75VDDQMZVBK3P7IQIBHSLYFMA.png)

Bitcoin daily chart. (CoinDesk Indices)

- Bitcoin has erased early gains seen after MicroStrategy's announcement to boost its coin stash and Fitch's downgrade of the U.S. sovereign credit rating.

- Risk assets, including bitcoin, took a beating after S&P downgraded U.S. in August 2011.

Bitcoin (BTC) reversed early Asian session gains as the dollar index and the Treasury yield recouped losses seen after Fitch downgraded the U.S. sovereign credit rating from the top score.

At 04:25 UTC, the leading cryptocurrency by market value changed hands at $29,600, down from the high of $30,032 registered at 01:30 UTC, per CoinDesk data.

The pullback reversed almost entire gains seen after bitcoin holder MicroStrategy announced plans to raise funds to boost its coin stash and the rating agency Fitch downgraded its credit rating for the U.S. government, from AAA to AA+, citing repeated brinkmanship over the debt ceiling.

The dollar index (DXY), which tracks the greenback's value against major fiat currencies, fell from 102.14 to 101.95 in a knee-jerk reaction to the ratings downgrade, only to bounce back to 102.25 at press time. The 10-year Treasury yield chalked out a similar drop and pop to hover above 4%. Bitcoin tends to move in the opposite direction of the greenback and bond yields.

Two of the so-called big three rating agencies have now placed the default rating at AA+. Moody's still has a top rating of AAA.

The S&P downgraded the U.S. to AA+ on Aug. 5, 2011, following which the dollar index and Treasury yields initially declined but quickly bounced back. Stocks tumbled, with bitcoin falling over 38% in the same month, data from TradingView show. The only major asset to rally alongside DXY was gold, which gained over 10%.

If history is a guide, the dollar index looks set to rise further, bringing more pain to bitcoin and stocks, although impending buying pressure from MicroStrategy might support the cryptocurrency's price.

As of writing, futures tied to the S&P 500, Wall Street's benchmark equity index pointed to a negative open with a 0.5% drop. As Asia began its business day, bitcoin jumped past $30,000 after software developer and bitcoin whale MicroStrategy submitted a filing with the Securities and Exchange Commission (SEC) to sell up to $750 million in stock with the intent of using the capital to purchase more BTC.

Major U.S. equity indexes – Nasdaq Composite and S&P 500 – fell 0.4% and 0.3%, on Tuesday.

In a note to CoinDesk, Mark Connors, the head of research at Canadian digital asset manager 3iQ, wrote that the recent "shift in market sentiment was NOT limited to digital assets, as equities took a breather."

"Our bellwether cross asset correlation metric hit a 20Y high as bonds and equities sold off," Connors wrote. "Looking forward, we will monitor for any sharp reversal from this historically high correlation - as that has often signaled a risk reversal."

ETH, CRV track BTC lower

The CoinDesk Market Index, a measure of crypto markets performance, pulled back from $1,290 to $1,279, but was still up 2% on a 24-hour basis.

Ether, the native token of Ethereum, fell 0.5% from early Asian session highs to $1,860 taking cues from bitcoin's negative turnaround. Per one analyst, ether is overvalued and could slide further. Options market is seeing price weakness over the next six months.

Curve's CRV token pulled back 5% to 58 cents. The cryptocurrency rose more than 20% to over 62 cents on Tuesday, likely on the back of a short squeeze. The increase came after Sun purchased more than $2 million worth of the token and pledged additional assistance through a liquidity pool on the Tron network. Curve fell victim to an exploit late Sunday, triggering a sell-off in CRV that got the market worried about potential liquidation of Curve founder's large borrowed position.

"Clearly, there are fears over a liquidation cascade happening within the Ethereum DeFi ecosystem, Richard Mico, the U.S. CEO of payment-and-compliance infrastructure provider BanxaI, wrote in an email to CoinDesk. "I don’t know how likely such a cascade is, but the market seems jittery as a result of these metastasizing issues. What’s ironic is that DeFi had held up so well during the blowups of 2022, and yet it’s an exploit more recently that might be the trigger for a DeFi blowup itself now."

Mico added that a judge's ruling against stablecoin issuer Terraform Labs' motion to dismiss a lawsuit against the SEC might "be adding to the relatively soft sentiment in the market," but he noted that investors were buying up bitcoin's recent "dips below $29,000...pretty quickly," a sign that buyers are accumulating in expectation of the SEC approving one of the recent spot BTC ETF applications.

UPDATE (August 1, 2023, 23:43 UTC): Changes headline and opening paragraphs to reflect MicroStrategy filing and bitcoin price increase.

UPDATE (August 2, 2023, 1:24 UTC): Reflects latest price increases for bitcoin and altcoins.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/0ce39235-9db0-4b82-a938-ae1d0516b491.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)